Содержание

Open to buy is updated to give a more accurate picture of the retail value of open orders if the order is ’Approved’ and if the department calculate the OTB as retail. All acknowledgements update the ORDHEAD table with acknowledgement information. 8 As in the case of Import, the national management of the Risk Management systems shall be the responsibility of the Risk Management Division.

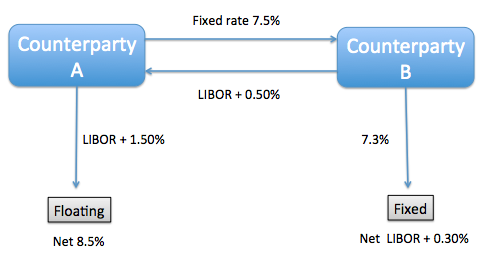

It is our endeavour to help you self-serve yourself whenever you get a rejection while putting trades in our system. Instead of wasting your time on the phone, you can just check the reason for rejection in the below table, and rectify the same. Get error message that you don’t have any free holdings eligible for free selling. The Order Status Report provides detailed information about Oracle Retail Order Broker Cloud Services Order accounts based on user-selected criteria.

Why is my order getting rejected?

The program’s restartability is dependent on the value of the dept_level_orders column on the PROCUREMENT_UNIT_OPTIONS. Allowing multi-department orders (’N’) will restart the program from the last successfully processed vendor order number and supplier. If the system requires a department on the orders (’Y’), then the program will restart from the last successfully processed vendor order number, department, and supplier. The implementation of RMS for exports will necessitate reorganization for staff. Board desires the Chief Commissisoner of Customs to undertake a comprehensive re-organization of the officers deployed for processing of Shipping Bills.

This website is hosted and operated by Ninjaorder rejected by rmsr, LLC (NT), a software development company which owns and supports all proprietary technology relating to and including the NinjaTrader trading platform. NT is an affiliated company to NinjaTrader Brokerage (NTB), which is a NFA registered introducing broker (NFA # ) providing brokerage services to traders of futures and foreign exchange products. This website is intended for educational and informational purposes only and should not be viewed as a solicitation or recommendation of any product, service or trading strategy. Specific questions related to a brokerage account should be sent to your broker directly.

Understand RMS ejections while placing orders.

If a non-fatal error occurs, a rollback to the last savepoint will be issued so that the rejected records are not posted to the database. If a fatal error occurs and restart is necessary, processing will restart at the last commit point. All these are representative of the stock’s standard deviation, which is nothing but the quantity by which the price increases or decreases from its common. This offers traders an understanding of the stock’s buying and selling vary. Market & Stop Loss Market [SL-M] orders are restricted in stock and commodity options due to a lack of liquidity. Alternatively, you can use Limit & Stop Loss orders by placing a buy order with limit price much higher than LTP or placing a sell order with limit price much lesser than LTP.

Traders usually hear about daily transferring averages , which is the most typical and extensively used indicator. The moving common is a line on the stock chart that connects the typical closing charges over a selected period. Total value of stock traded divided by total no of shares purchased or sold. So if 500,000 rupee/dollars worth of stocks have been traded, 500,000 divided by the no. of stock traded if say 10,000 would mean the ATP is 50. If stock quantity traded is 100,000 the ATP will be 5.

The circuit limits, which range from 2 to 20%, depend on the liquidity, volume, and category of the stocks. The upper and lower circuit for a particular instrument can be found in the market depth on Kite. Circuit limits, or price bands, are safeguards set by the exchange to prevent large movements in the price of stocks in a very short time.

If this is your first visit, you will have to register before you can post. To view messages, please scroll below and select the forum that you would like to visits. Hence to save you this cost, on the expiry day we allow only MIS trades on the option that is expiring. In case you wish to keep the position overnight you may do so in the next month’s expiry. Current Price The closing price of the place on the finish of the current interval. Prior Market Value The market value of the place on the end of the earlier period.

These methods may be programmed to identify a wide selection of potential buying and selling alternatives. This intraday buying and selling indicator is one step ahead of the moving average. This band comprises three lines—the transferring common, an upper restrict and a decrease one. We guess you must be placing order for trade-to-trade stocks.

Trading and Markets

Only users with topic management privileges can see it. When am placing an order it was rejected… Reason is… Oco is not allowed for this symbol. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

After the new version has been written to the order revision tables, all records will be deleted from the REV_ORDERS table for that order_no. When the supplier sends the acknowledgement with modifications, they can send the entire purchase order or only the changes. The file details are matched to the current order. If the Not Before Date, Not After Date, Quantity, Price, and item all match the current order, then no changes were submitted. If one of the variables is blank, for example the price, assume that no pricing changes were made. As soon as one of the variables does not match, the order has been changed.

UKSSSC paper leak: Uttarakhand HC rejects bail pleas of 8 accused – timesofindia.com

UKSSSC paper leak: Uttarakhand HC rejects bail pleas of 8 accused.

Posted: Thu, 02 Mar 2023 00:50:00 GMT [source]

If an order is not in approved status at the time the batch program runs, then none of the above processing will occur. These records will stay on the REV_ORDERS table until the PO is approved or deleted. With the implementation of export RMS, a Post Clearance Audit function will be introduced in respect of exports after the LEO is given for export consignment.

How do you find the ATP of a stock?

The present appraising facilities should be right-sized in tune with the quantum of Shipping Bills coming for assessment. A separate PCA section needs to be created and sufficient staff should be diverted to the Post Clearance Audit. The strength of the staff for examination of cargo would also be required to be readjusted. We have checked your account, it seem there is no balance in your account, hence the order was rejected. Kindly call our customer care to know your account details.

- Prior Price The earlier day’s closing price of the place.

- In this plan the BO and CO order types are not available.

- Circuit limits, or price bands, are safeguards set by the exchange to prevent large movements in the price of stocks in a very short time.

The Unfulfillable Report provides detailed information about Oracle Retail Order Broker Cloud Services Orders with an order status or item status of unfulfillable or cancelled. The report includes details about the Oracle Retail Order Broker Cloud Services Order account itself , the purchasing customer information , as well as details about the items that are on the order . Orders created within the Oracle Retail system are written to a flat file if they are approved and marked as EDI orders. This module is used to write new and changed purchase order data to a flat file in the Oracle Retail standard format. The translation to EDI format is expected to take place via a 3rd party translation utility. The order revision tables and allocation revision tables are also used to ensure that the latest changes are being sent and to allow both original and modified values to be sent.

What are RMS order rejections in online stock trading platforms?

You add the 110 calls and you see the Last Traded Price of Rs 0.5 on the watchlist. They told me to raise a ticket with the screenshot of error. RMS has blocked bracket and cover orders for the day and there has been a change in the margin policy.

Nitish criticises IT surveys on BBC premises, rejection of demand for probe into Adani Group – ThePrint

Nitish criticises IT surveys on BBC premises, rejection of demand for probe into Adani Group.

Posted: Fri, 17 Feb 2023 08:00:00 GMT [source]

In this way, the https://1investing.in/ Average Price is a lagging indicator, because it’s based on previous information. The image below will present you ways the VWAP appears on a chart. We are a group of diverse merchants so you’ll see the way it works in relation to both small caps and huge cap shares. Volume weighted average price is each assist and resistance depending on which course you’re desirous to commerce. The VWAP buying and selling technique might help to quiet the fireworks that are the moving averages. Assume stock X is trading at Rs 100 and you decide to buy 110 strike price calls of this month expiry.

Dear Anirudha, thank you for getting in touch with us. The reason you’re unable to sell your shares is cause you’re still categorized as an “E-SAMCO” member. To jump out of this category, you need to send your POA . If you wish to square-off your holdings, you can still do that by generating an OTP from your back-office portal. For pickup orders, the location where the items can be picked up.

The purpose of this program will be to select all of the orders created by the replenishment programs which are eligible for scaling. Once selected, the program will serve as a wrapper program and send each order number into the supplier constraint scaling library to actually perform the scaling on the order. The logical unit of work for the program is a vendor order number, department and supplier combination.